Schedule C Meals Deduction 2025

Schedule C Meals Deduction 2025. Effective january 1, 2026, new §274(o) provides that no deduction is allowed for any expense for a de. Food and beverages were 100% deductible if purchased from.

Ok, now that meal deductions are cleared up — sort of; What percent of meal expenses are deductible on form schedule c?

Schedule C Meals Deduction 2025 Images References :

Source: florryqdianemarie.pages.dev

Source: florryqdianemarie.pages.dev

Schedule C Meals Deduction 2025 Chelsy Mufinella, Call your tax advisor about your specific needs.

Source: classcampusbreeze.z21.web.core.windows.net

Source: classcampusbreeze.z21.web.core.windows.net

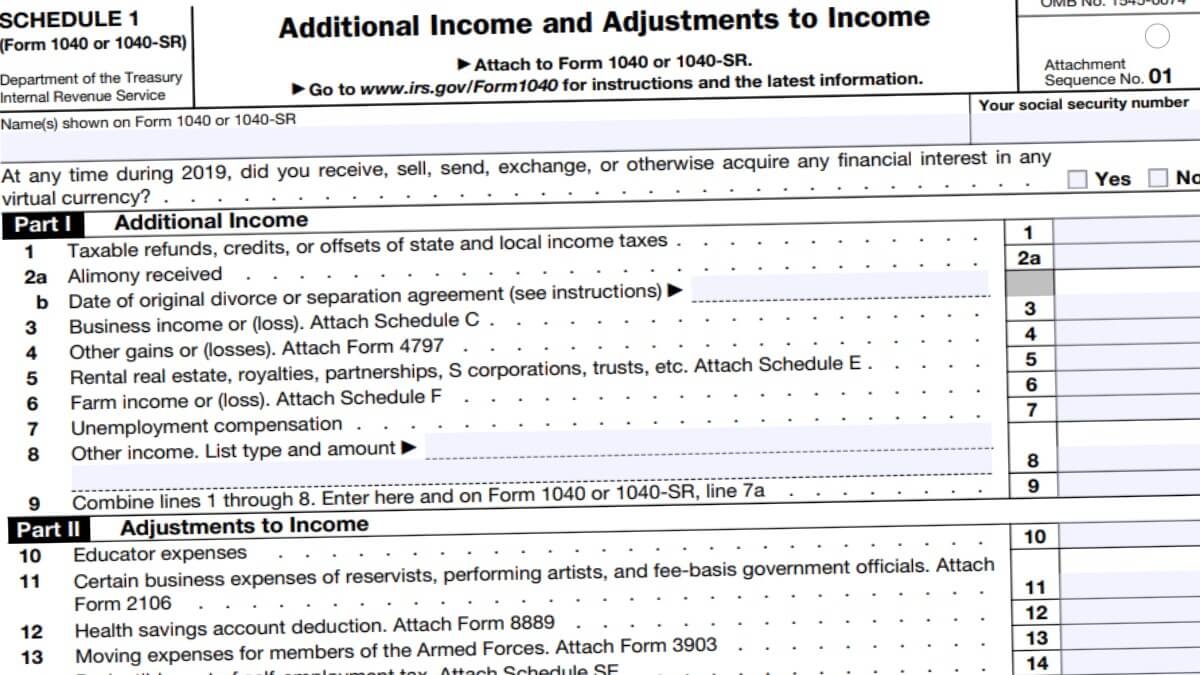

Ira Deduction Worksheet Schedule 1 Line 20, Food and beverages were 100% deductible if purchased from.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

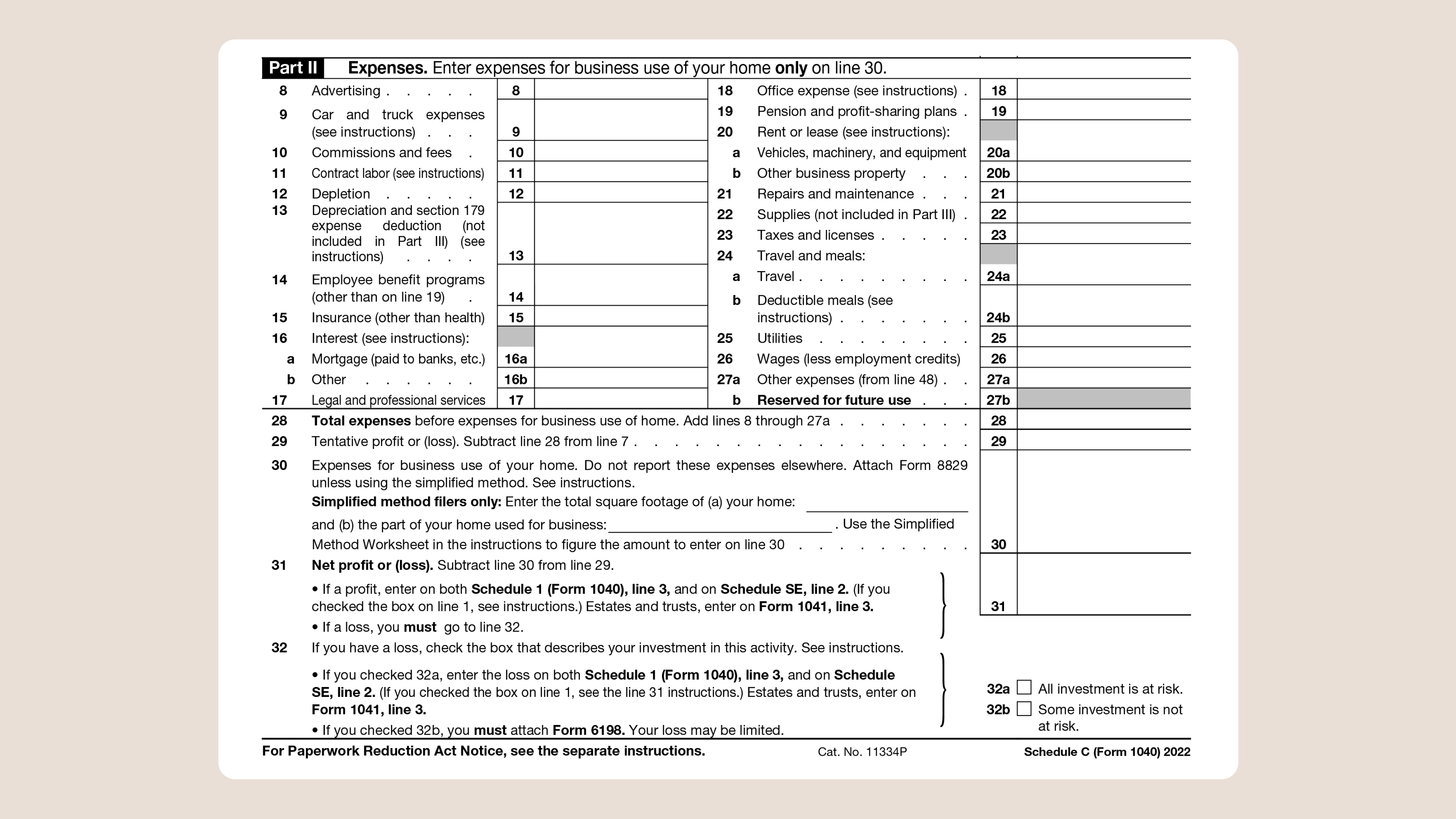

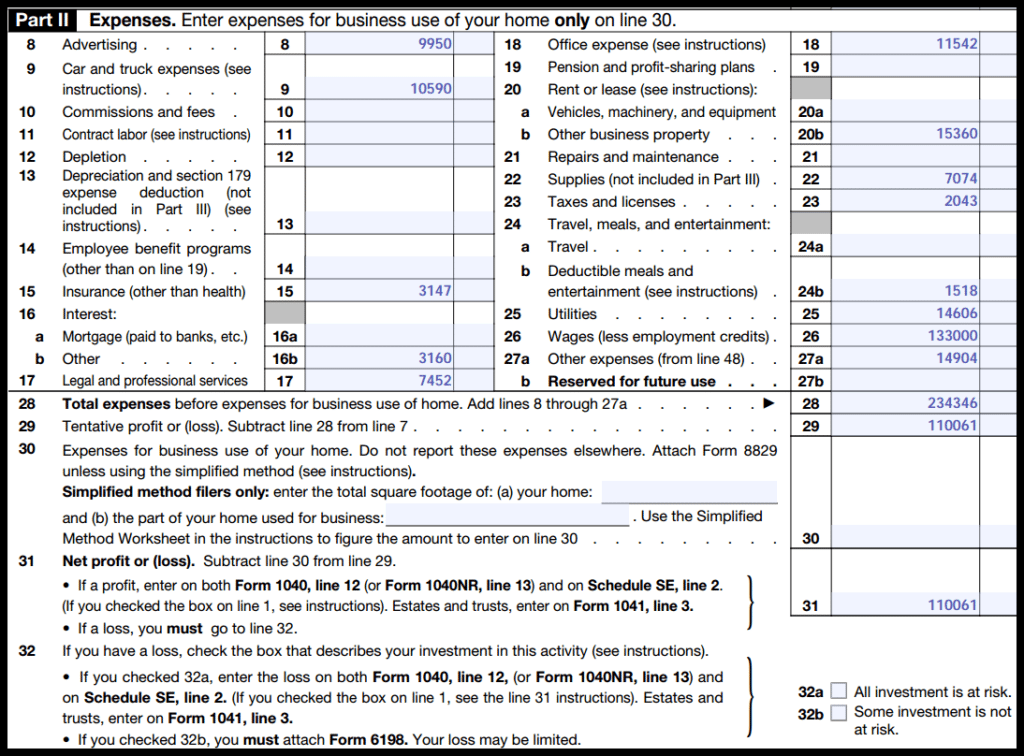

How to Complete Schedule C Profit and Loss From a Business, As part of the consolidated appropriations act signed into law on december 27, 2020, the deductibility of meals changed.

Source: spiegel.cpa

Source: spiegel.cpa

2022 Meal & Entertainment Deductions Explained Spiegel Accountancy, The allowable amount of meal expenses you are allowed to deduct on your schedule c is determined by the line of work you are in.

.jpg) Source: slideplayer.com

Source: slideplayer.com

Gross Exclusions ppt download, 2025 meals and entertainment deduction.

Meals Deduction 2025 Evy Clarinda, No deduction for meals provided for convenience of employer after 12/31/2025.

Source: pippybmelany.pages.dev

Source: pippybmelany.pages.dev

2025 Meals And Entertainment Deduction Lissy Shandra, The meals and entertainment deductions reference chart is a tool to help navigate the changes in irc § 274.

Source: audriebcatharina.pages.dev

Source: audriebcatharina.pages.dev

Meal Deduction 2025 Becka Fayette, When you review a schedule c.

Source: pippybmelany.pages.dev

Source: pippybmelany.pages.dev

2025 Meals And Entertainment Deduction Lissy Shandra, The temporary 100% deduction for food or beverages provided by a restaurant has expired.

Source: pippybmelany.pages.dev

Source: pippybmelany.pages.dev

2025 Meals And Entertainment Deduction Lissy Shandra, On schedule c, line item 24b is for meals and entertainment.

Category: 2025